Since the last few months, the markets have been more volatile and specifically post the budget, the markets have been seeing a bearish run.

What has been happening?

Some of the factors leading to the markets reacting in a volatile manner are stated below:

- Election Results: On May 23rd, BJP government led by PM Modi got re-elected with a huge majority. It lifted the markets as hopes for strong economic growth was very high.

- NBFC Liquidity Issue: It all started with IL&FS defaulting in the latter half of 2018, but the issue became even worse with DHFL also defaulting on June 22nd and its rating getting downgraded to default. Since then mutual funds and financial institutions have tightened the lending to NBFCs. As a result, liquidity to NBFCs has become an issue and that also affected their stock prices.

- Q1 2019 Earnings: Most of the Nifty 50 companies missed the analysts’ estimates. This also led to furthering of the bearish sentiment in the market.

- Auto Sector Slowdown: India’s automobile industry sank deeper in July with sales at some of the top passenger vehicle makers plunging to their worst in about two decades. We expect the recovery of the sector in the coming months due to the start of the festive season. (During the festive season, auto sales are high).

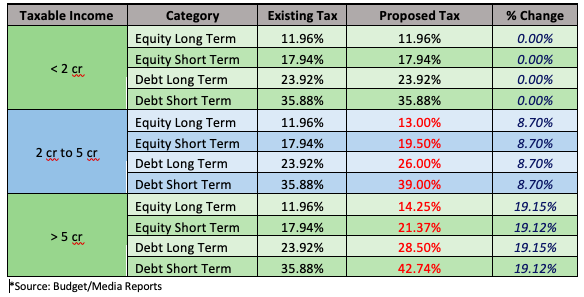

Budget: This budget saw the announcement of higher tax rates for the rich. Below are the proposed tax slabs and effective tax rates

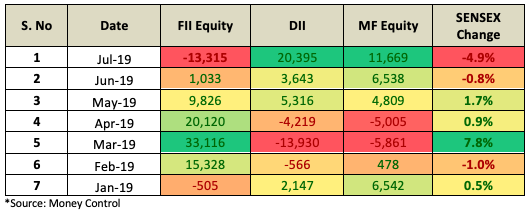

This led to large pull-outs from foreign institutional investors (FIIs). In July, FIIs saw a huge outflow while domestic institutions were net buyers.

Below table shows the FII, DII flows during the year –

The main reason for domestic institutional investors’ participation is overall valuations.

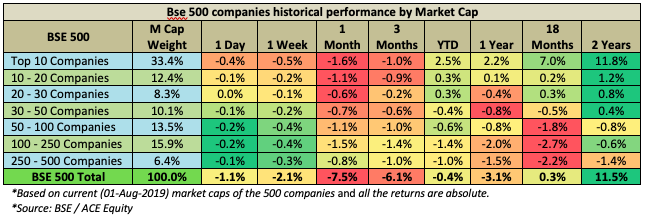

- Skewed Markets: Since the last 18 months, the market (Nifty & Sensex) has been positive only because of very few large cap companies’ performances.

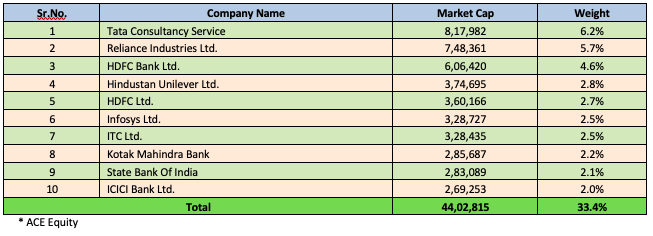

In the above table, only the top 10 companies by market cap have delivered 11.8% returns vs the total BSE 500 return of 11.5% in the last 2 years; rest of the 490 companies have delivered -0.4% returns. This means the positive returns of the BSE Sensex, Nifty and BSE 100 index is because of these ten companies.

Opportunities Galore

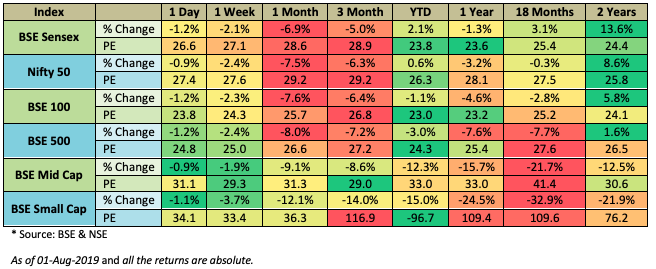

The comparison among different indices gives a lot more clarity about the rally and also the opportunities available in the market.

- Both BSE Sensex and Nifty 50 have delivered higher returns in the last 2 years and their valuations (PE) also increased because of the rally in few select large-cap stocks.

- BSE Mid and Small Cap index delivered negative returns and their valuations also came down sharply. Few select mid and small-cap with good growth rates are trading at a discount indicating a good time to start investing in good quality companies & funds in this space.

In Conclusion

Every sector goes through down cycles at some point. It is important to identify high-quality companies or funds available at attractive valuations and invest with a long term horizon. If we look in the past, the banking sector was in a bad shape in 2016 with high NPA issues. At that time, we recommended banking funds to our clients. While one could not time the turnaround, those who invested then ended up making over 20% CAGR. Similarly, we recommended investing in the tech & pharma sectors in 2017. A point to remember is that this doesn’t mean that every sector/cycle is good. For example, we have kept away from the real estate sector because of the issues related to high debt which is a more fundamental problem than cyclical.

Given the above analysis, we strongly recommend using the current market conditions as an opportunity for investing.