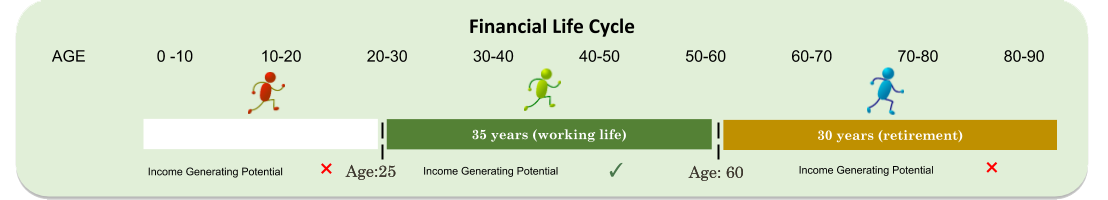

Financial Life Cycle

It’s important to answer the below questions because of your financial life cycle

Retirement/Goals

- How much do I need to save?

- When do I need to save?

- What will my living standard be?

- How can I change my situation?

Investments

- How much do I need to invest?

- When should I invest?

- Where should I invest?

- What should I expect out of my investments ?

Insurance/Risk

- Why do I need to invest?

- What type do I need?

- How much do I need?

- When should I get insurance ?

The 35 years of income generated has to provide for the 30 years of retirement (keeping inflation in mind) !

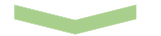

Education: Investment Options

Education: Equity

Equity Definition : Equity is the net amount of funds invested in a business by its owners. Simply put, equity is ownership in a company.

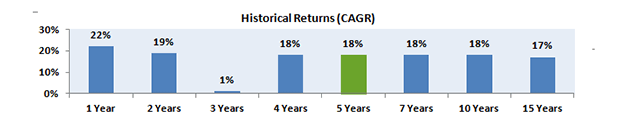

The stock market is subject to short-term fluctuations. But over the long term, the stock market has historically performed well.

And over the short to medium term, the returns from equities tend to be volatile. However, over the long term they become surprisingly predictable.

Education: Bonds

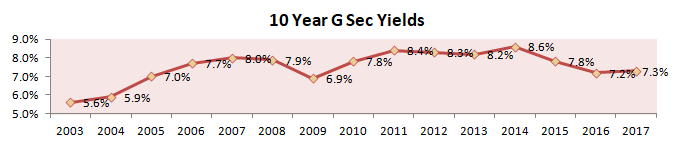

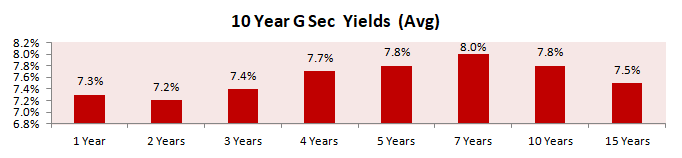

A Government Security (G-Sec) is a tradable instrument issued by the Central Government or the State Governments. It acknowledges the Government’s debt obligation. Such securities are short term (usually called treasury bills, with original maturities of less than one year) or long term (usually called Government bonds or dated securities with original maturity of one year or more). G-Secs carry practically no risk of default and, hence, are called risk-free gilt-edged instruments.

Yields in G bonds are also volatile based on economic scenario, it linked with Inflation

In recent years inflation is in downward trend, so bond yields are also likely to follow.

Tax : Short term gains (less than 3 years) are added to Income and taxed at applicable tax rates, where as long term gains(more than 3 years) are taxed at 20% with indexation benefit and 10% without indexation benefit.

Education: Real Estate

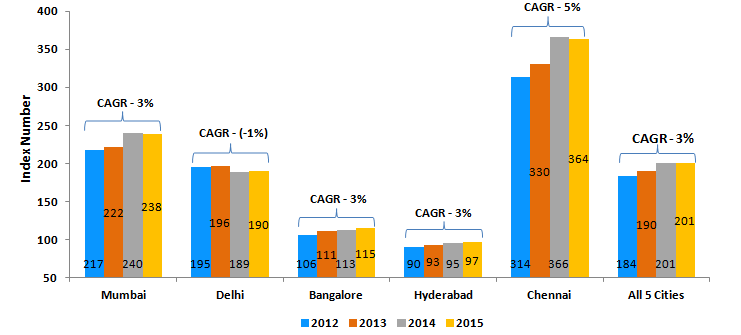

Residex is a housing price index updated quarterly by National Housing Bank (NHB). NHB, the Apex level housing finance institution wholly owned by Reserve Bank of India (RBI), regulates activities of housing finance companies (HFCs) in India.

NHB Residex tracks residential property prices in 26 cities with the starting index value of 100 and 2007 as the base year. Residex tracks prices over a period of time by dwelling size (small / medium / large) and location (city / zones / locations).

From Jun -13 to June -17

| City | CAGR |

| Delhi | 0.20% |

| Hyderabad | 5.40% |

| Chennai | 6.50% |

| Bangalore | 7.20% |

| Mumbai | 7.50% |

Tax : Short term gains (less than 2 years) are taxed at 20%, where as long term gains(more than 2 years) are taxed at 20% with indexation benefit.

Residex is a housing price index updated quarterly by National Housing Bank (NHB). NHB, the Apex level housing finance institution wholly owned by Reserve Bank of India (RBI), regulates activities of housing finance companies (HFCs) in India.

NHB Residex tracks residential property prices in 26 cities with the starting index value of 100 and 2007 as the base year. Residex tracks prices over a period of time by dwelling size (small / medium / large) and location (city / zones / locations).

From 2012 to 2015 residential property prices of Mumbai, Delhi, Bangalore, Hyderabad and Chennai are grown by 3% CAGR.

Tax: Short term gains (less than 2 years) are taxed at 20%, where as long term gains(more than 2 years) are taxed at 20% with indexation benefit.

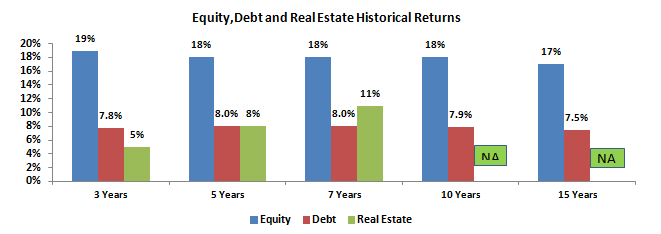

Consolidated of all Securities

Equity, Debt and Real Estate Historical Returns

Real Estate returns are inclusive of 2% rental yields.

*Estimated

| Equity | Tax Rate |

|---|---|

| < 1 year | 15% |

| > 1 year | 0% |

| Debt | Tax Rate |

|---|---|

| < 3 years | 20% |

| > 3 years | 20% with indexation or 10% flat |

| Equity | Tax Rate |

|---|---|

| Rental Income | Taxed at slab rates |

| STCG < 2 years | 20% |

| LTCG > 2 years | 20% with indexation |