World economy has seen major shock in the last 2 quarters, declining margins for several companies, employees being laid off, several small businesses being shut down and a major impact on the stock markets.

Although the markets had seen such events previously, Dow Jones almost fell 89% during the great depression of 1929, in comparison Dow Jones saw almost -35% fall due to the coronavirus outbreak. Sensex too had fallen -40%. Devastating for Indian Investors and the economy. A strong financial market is extremely essential for the development of an economy.

Since then we have seen a major recovery in the global stock markets. S&P 500 gained more than 10% after it’s full recovery to the pre-COVID levels and so has Sensex.

While a strong participation in the stock markets is substantial to drive the growth, we see a very different level of participation in developed vis-à-vis emerging economies. While emerging markets tend to show higher growth rate backed by a younger working population, new business development, infrastructure development, the participation in the stock market is minimal.

Source: The Money Project

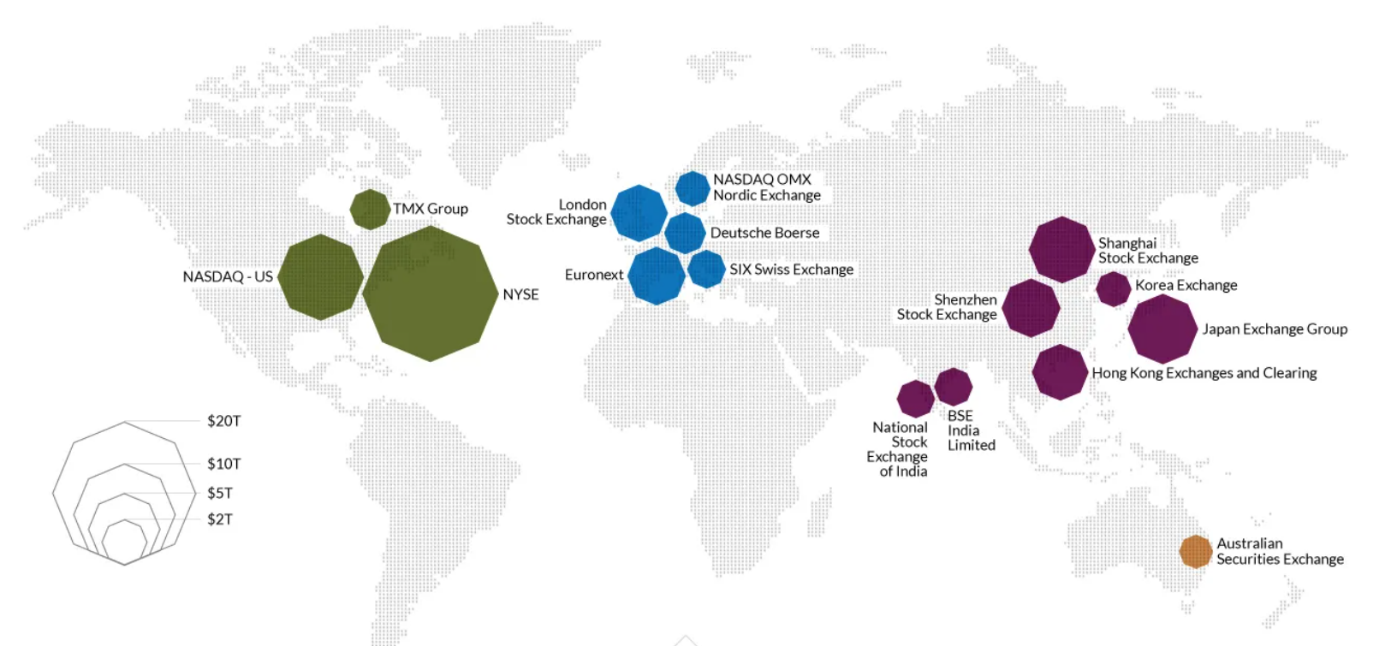

Over 93% of global stock value is spread across three continents: North America, Europe & Asia. US holding majority of the stock value, NYSE itself is bigger than the world’s 50 smallest major exchanges combined together.

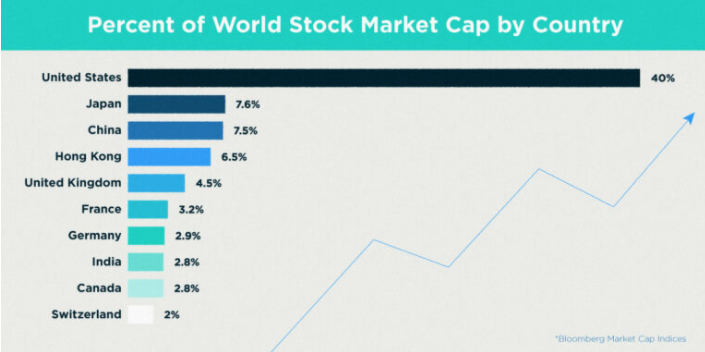

To put this into perspective, the United States is a $21 trillion economy while India is only $2.6 Trillion. India is only 13% of the US economy, however India sees a faster GDP growth rate.

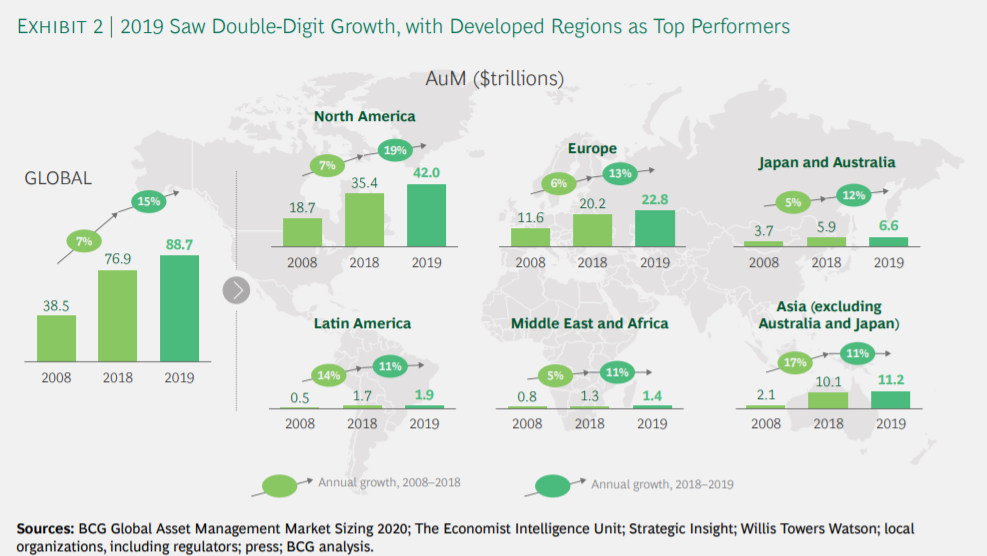

More than 25% of the US population participates in the stock markets, invests in over 10,000 Mutual funds managing an AUM (Asset under Management) of about $17.7 Trillion. In comparison only 3% of Indian population participates in the stock markets which has around 2000 Mutual funds managing an AUM of $0.5 Trillion. While the US economy also participates in more than 10,000 hedge funds, India doesn’t have any hedge funds as of yet.

North America is the major contributor towards the global Asset under Management

We can see this striking gap between the participation made in the development countries versus developing ones. There is a huge opportunity for growth in the emerging markets. Unlike the US, where the company size is already huge for companies like Alphabet & Microsoft itself, the entire market cap of Indian economy is $2 Trillion. Indian companies still have a lot of potential and opportunity for growth. The US has the highest stock market capitalization.

Parmendra Sharma in his article on Stock markets writes that stock markets help banking systems in providing five broad financial functions, essential for proper functioning, growth and development of economies: (i) information production and capital allocation; (ii) corporate governance; (iii) risk management; (iv) savings mobilization; and (v) the exchange of goods and services

A total bank-based system of economy may hinder innovation & growth in the corporates or encourage bank-corporate collisions creating a grave threat to corporate governance.

Participation in the stock market becomes extremely essential for emerging markets for the following reasons:

- It proves a highly effective way to channelize your savings into investment instrument

- Drastically attracts foreign financing into the country

- Increases the reallocation of financial assets into better instruments

- Compliment the developing Banking sectors

- Countries with liquid stock market enjoy faster growth rates

- Stock markets are essential for venture equity financing

While the majority of the population from the developed countries have been a part of the investment cycle may it be directly or indirectly, i.e. stock markets or mutual funds, the population from the lesser developed countries and still developing countries have been trying to improve.

There is a possibility for the latter to have tremendous growth in the foreseeable future and surpass the former in the percentage of the investing population, but only if the whole population is provided with education and training regarding financial inclusion and various types of investment opportunities present in the market.