It’s safe to say that you define risk differently than I do unless you too are a young professional who is striving to become financially stable and secure. And yet there is a certain common ground that leads a way to discussions. Differentiating between specific risks and common is indeed, a tedious task.

What is your risk appetite? I mean, really. It’s a culmination of a plethora of variables such as your age, income, dependents, debts, expenses, retirement age, assets etc. Your investments become a story summary of your risk appetite. To each its own. While your personal circumstances define how you would approach investments, there are certain common risks often misunderstood.

-

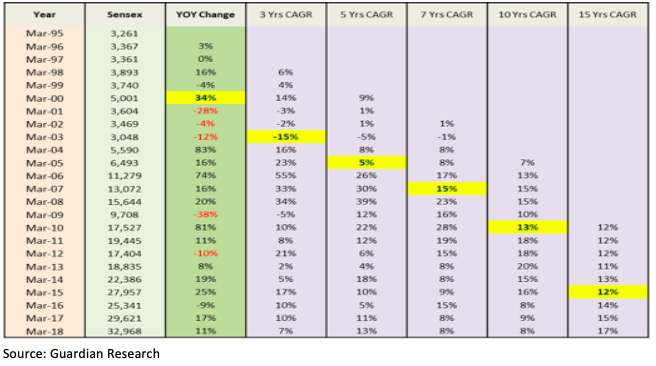

- Market risk: Failing to understand the markets you invest in, is a huge mistake that people make. Have you ever had sleepless nights over the stock markets falling drastically? Or Investments made when the markets were at the peak? Meh. It’s impossible to time the market. Patience is the key here. Thorough research of the last 25 years SENSEX data (Refer to the chart below), shows that even when you entered the market at its peak (at 34% growth as highlighted in yellow in the chart), the only time your money erodes is in the short term (<5 years). In the long run, you end up making money. Markets are often highly volatile so much so that it can fluctuate by 40%, don’t fret, all you got to do is wait. What goes around comes around. The real risk is not volatility but odds of losing money.

-

-

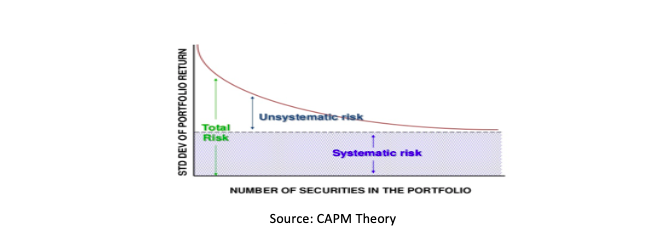

- Diversification: Targeting the right sectors and being focused in your investment decisions is essential here. The idea is to invest in stocks that have high growth rates on the top line yet trade at a lower price. You do not want to buy an overpriced asset to incur a loss, do you? You can eliminate the company-specific risk (unsystematic risk) but you cannot avoid market risk (systematic risk) by diversifying. Less than 30 securities are all you need to avoid the unsystematic risk, beyond which diversification won’t be of much help. How did I come up with this number, you ask? Oh well. There are several filters to be applied, such as shortlisting those companies which have the market capitalization >₹2500 cr, Revenue growth rate >10%, EPS growth rate >12%, Average Profit after Tax > 10%, and P/E ratio of <35. Voila! You end up with only 30 companies out of the 500 companies in the Index.

Excessive diversification doesn’t really deliver returns; it ends up limiting your upside. You could buy all the stocks in the index yet end up making minimum returns, if not losses.

Excessive diversification doesn’t really deliver returns; it ends up limiting your upside. You could buy all the stocks in the index yet end up making minimum returns, if not losses.

- Diversification: Targeting the right sectors and being focused in your investment decisions is essential here. The idea is to invest in stocks that have high growth rates on the top line yet trade at a lower price. You do not want to buy an overpriced asset to incur a loss, do you? You can eliminate the company-specific risk (unsystematic risk) but you cannot avoid market risk (systematic risk) by diversifying. Less than 30 securities are all you need to avoid the unsystematic risk, beyond which diversification won’t be of much help. How did I come up with this number, you ask? Oh well. There are several filters to be applied, such as shortlisting those companies which have the market capitalization >₹2500 cr, Revenue growth rate >10%, EPS growth rate >12%, Average Profit after Tax > 10%, and P/E ratio of <35. Voila! You end up with only 30 companies out of the 500 companies in the Index.

- Mismatch between Goals and Investments: Don’t chase returns rather chase goals, make sure to invest in the right kind of product. Don’t go investing in Equity for your short-term goals. For any goal less than 5 years invest in debt and >5 years invest in equity. Equity markets are volatile and need more time to deliver better returns. Don’t lock your money in long term instruments if the need is for short term.

-

-

- Buying wrong products: Identify your needs correctly, and buy products matching the needs. For life insurance needs buy Term insurance. A prudent investor knows not to mix investing with insurance. Insurance is a long-term commitment, don’t link your goals to it. You will lose the flexibility to move around your money. Often locking a lot of money only in real estate is very risky decision, since the return cycle is so long for real estate you can never predict if you’ll get the expected returns exactly when you need it.

A smart and foreseeing investor shall know how to analyze the risks in the right manner and to drift away from the myths and fake methods. The risk brackets put any investor into different categories like an aggressive investor or conservative investor. Every individuals’ financial goals might be different from others. Following the steps of others blindly might make you a sheep in a herd.