People automatically associate the word ‘invest’ with two avenues: gold or real estate. I don’t have some hard data to back up this claim, I’ve come to this conclusion through my experience of starting Guardian. The very first step we had to take, was to educate people on various investment options—and show them how gold and real estate weren’t remotely safe or secure bets.

The Gold Myth

It’s bright. It’s shiny. Sometimes, it’s splashed all over people’s living room and it makes you go ‘oh dear God, that’s tacky.’

Parents love gold—they’re all ‘invest in gold, everything else is a gimmick.’ Or they might say ‘you can touch gold, you can’t touch stocks.’

I suppose you can see gold, you can touch it—therefore it makes you think it’s more ‘real’ than anything else, but…

…what it isn’t, is a good investment.

The only time the value of gold goes up, is when there’s a disruption in the market. So, during a recession? Sure, gold goes up. But now that the economy’s stabilized and is doing well? Not really. And I do have some data to back up this particular claim.

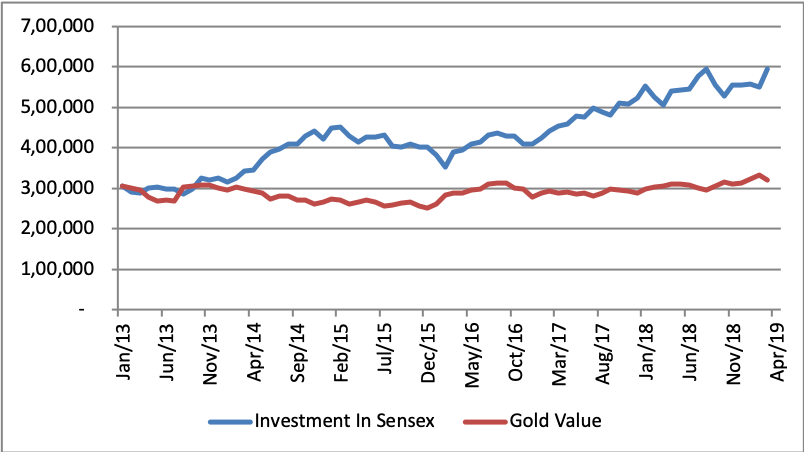

What if I’d purchased 100 grams of gold for investment purposes in January of 2013 at INR 30,520 per 10 grams—so I invested a total of INR 3,05,200. And let’s say that I happened to have another INR 3,05,200 lying idle, so I put that particular sum in the BSE Sensex.

The current value of my investments (as of March 2019) would be: INR 3,20,361 in gold and INR 5,93,264 in the BSE Sensex. The investment in gold would have remained close to stagnant with a nominal annual growth rate of 0.8%, while the Sensex would have given returns of 10.9%. In other words, the money invested in the Sensex would have grown to almost double that of the investment in gold.

The graph below shows this movement:

*Source—BSE and RBI

The Even Bigger Real Estate Myth

“But come on, seriously—there’s no secure investment like real estate”…heard countless times at weddings and dinner parties when supposedly wise men start talking business.

And then the stories come up—“so and so bought a piece of land near some highway and now it’s worth crores.” Hushed whispers are bound to follow—‘wow’ ‘even I wanted to buy in that area’ ‘lucky.’

Now, that one story may be true—what we don’t hear is countless other stories where things didn’t go down so well.

That one time when someone may have bought property, but the papers weren’t 100% clean—then they had to sell the property and lose money on it, barely avoiding a legal scandal.

That one time when someone constructed many apartments in one ‘posh’ area—but the city grew in a different direction. Rents in the previously posh area are permanently down.

That one time when someone bought two apartments in a growing area…but the area kept growing, and growing, and growing. Tons of other construction firms swarmed in to build apartment complexes in that area. And now there’s an oversupply.

That one time when someone in a cash crunch tried selling their property…except they couldn’t find a buyer…and had to sell at a deeply discounted price.

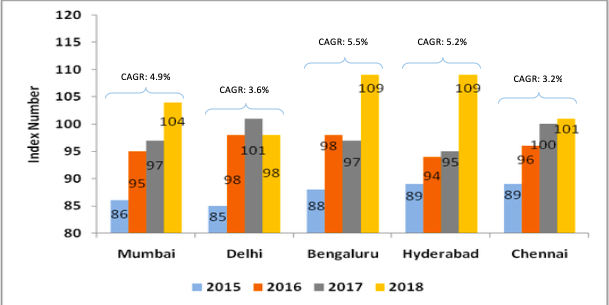

We’re all familiar with these stories, but we don’t like thinking about them. We like thinking about the one person who bought land, and the value of said land tripled, quadrupled, or even quintupled. All I have to do to dispel the real estate myth is point you towards the graph below.

*Data source—National Housing Bank

What this graph shows you is that from 2012 to 2015 residential property prices of Mumbai, Delhi, Bangalore, Hyderabad and Chennai are grown by 4.48% CAGR. Let me repeat that—4.48 % CAGR.

That’s it, folks. 4.48%. Let’s be generous and take rental yields into account—I’ll add 2% to that number. It’s still only 6.48%.

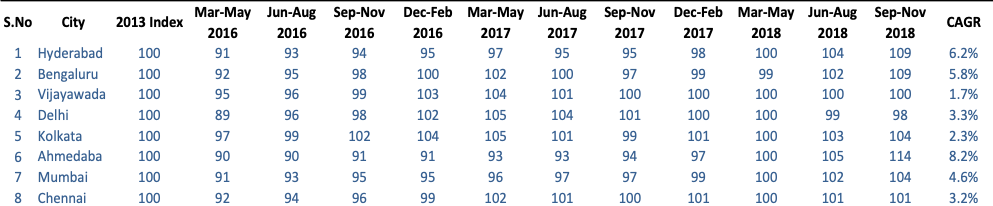

If the data isn’t sufficient enough for some skeptics—let me show you another table.

* Source: National housing bank (owned by Reserve Bank of India)

Apart from Ahmedabad, the numbers aren’t too impressive.

Is the hassle worth it?

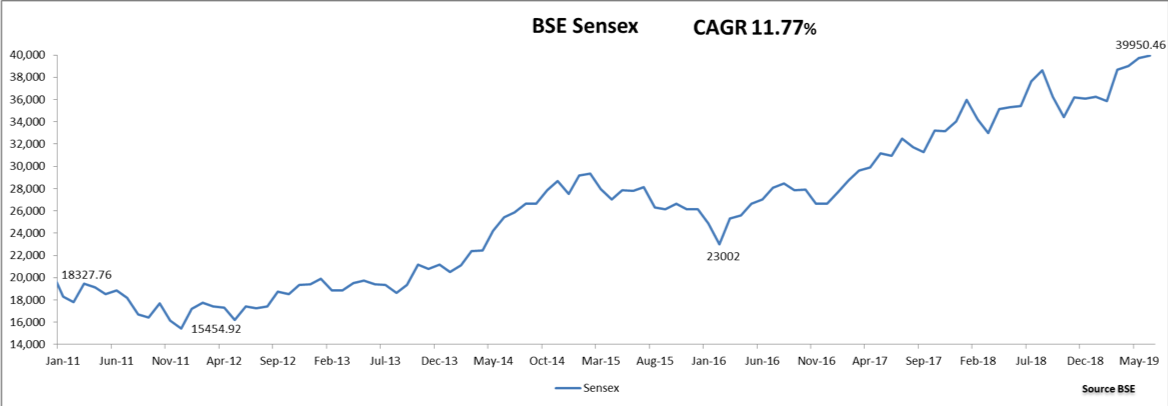

I think that’s an easy answer, especially if you look at the graph below—last graph, I promise.

*Data source: BSE

You didn’t even require a grand investment strategy [although, it’s better to have one all the same]. All you had to do was invest in the Sensex in 2011, and you’d have built up a CAGR of 11.7%.

Without the hassle of dealing with seedy brokers or dusty government offices—without the fear of being cheated out of money—without legal repercussions due to incomplete paperwork, and with the additional bonus of being able to liquidate your holdings instantly.